Leases change hands all the time. However, the purchase of Anadarko, currently the Gulf’s third largest deepwater leaseholder, by Oxy may generate unique acquisition opportunities. As of August 19th, Anadarko has record title interests in 212 leases in water over 200 meters (656 feet). Oxy may retain some, none or all of them in its ultimate GOM portfolio. Most likely, however, many of Anadarko’s holdings will be available for acquisition or farming-in, generating extreme focus on assessing their values.

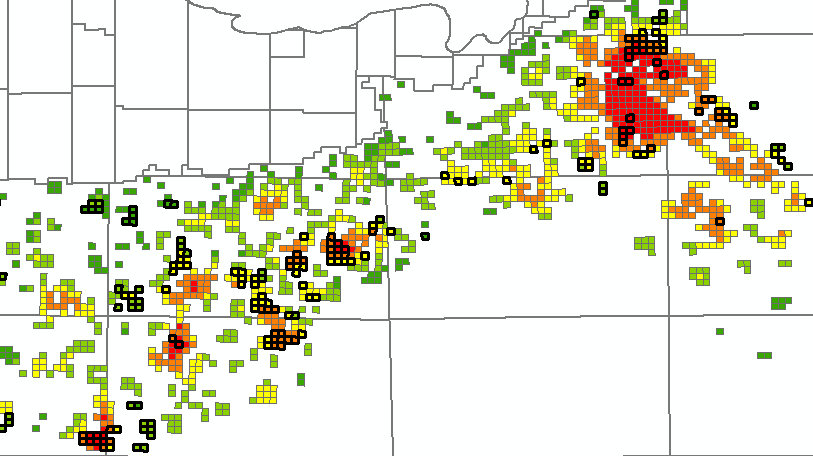

Current leases with estimated bid amounts if they were available in Sale 253. Anadarko leases with black outlines.

Much of the information for a comprehensive evaluation is available in GOM3. This includes complete leasing, drilling, and production histories. In addition to BOEM’s reservoir and field-level assessments of remaining resources, we have independent decline curve analysis of all completions and reservoirs. We have identified where producible resources remaining in abandoned reservoirs in our Forgotten Oil and Gas Study. On the liability side, we have data on the block-level cost of well and facilities decommissioning. All of this information can also be useful in managing your own properties, particularly in the case of potential resources on farmed-in blocks.

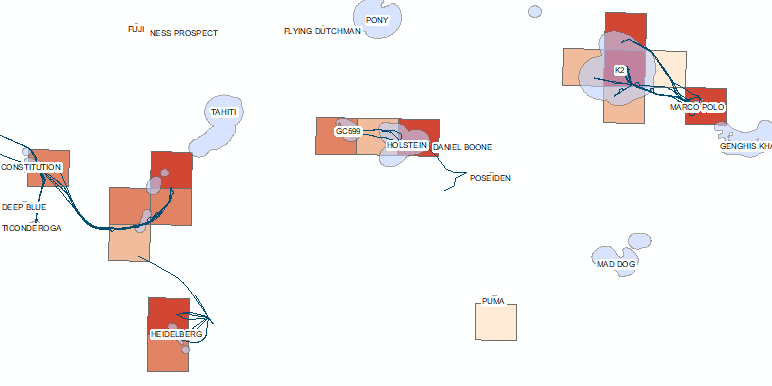

Anadarko leases colored by decommissioning liabilities in Green Canyon. Pipelines are Anadarko-operated right-of-way pipelines only.

The second of the two offerings of this free webinar providing potential contributions to lease evaluations using Anadarko as our case study. The topics will include:

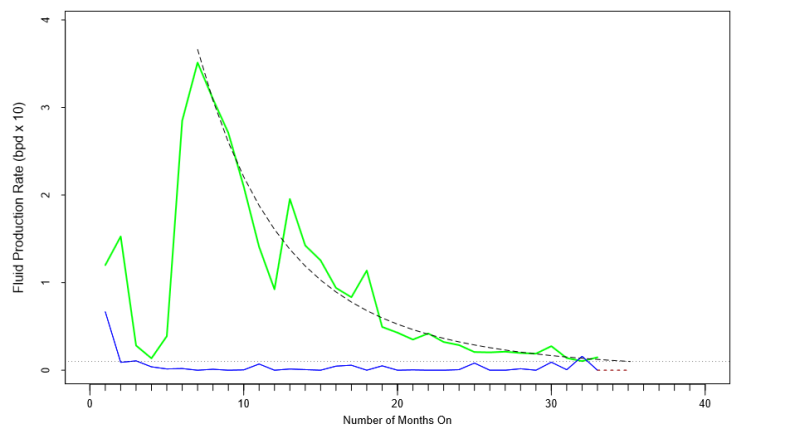

Just a quick, though late, update on the Forgotten Oil & Gas Study: Decline curve analysis can now be run individually on any reservoir in the Gulf of Mexico. This new option is available in the Forgotten Oil & Gas Study page of the Business Planning Add-on to GOM3. A large amount of work went into cleaning up the reservoir names and verifying completion intervals spatially to ensure that hydrocarbons were not produced from subsequent completions. After choosing a reservoir, similar options to decline curve analysis on completions are chosen (economic rate limits, water cuts, etc.). In this way detailed analysis can be run for the reservoir beyond the total estimates remaining in the package spreadsheets.

Decline curve analysis for a Green Canyon reservoir.

Decline curve analysis for a Green Canyon reservoir.